New Delhi, February 01, 2025: There will be no income tax payable upto income of Rs 12 lakh under the new regime, presenting the Budget in Parliament today Union Minister for Finance and Corporate Affairs Nirmala Sitharaman said.

This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000, The Finance Minister said.

Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Presenting the Budget Sitharaman proposed an across-the-board change in tax slabs and rates to benefit all tax-payers.

Giving the good news to tax payers, the Finance Minister stated,

“There will be no income tax payable upto income of Rs. 12 lakh (that is average income of Rs.1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000.” Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Sitharaman said, “The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment”.

In the new tax regime, the Finance Minister proposed to revise tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 per cent |

| 8-12 lakh rupees | 10 per cent |

| 12-16 lakh rupees | 15 per cent |

| 16-20 lakh rupees | 20 per cent |

| 20- 24 lakh rupees | 25 per cent |

| Above 24 lakh rupees | 30 per cent |

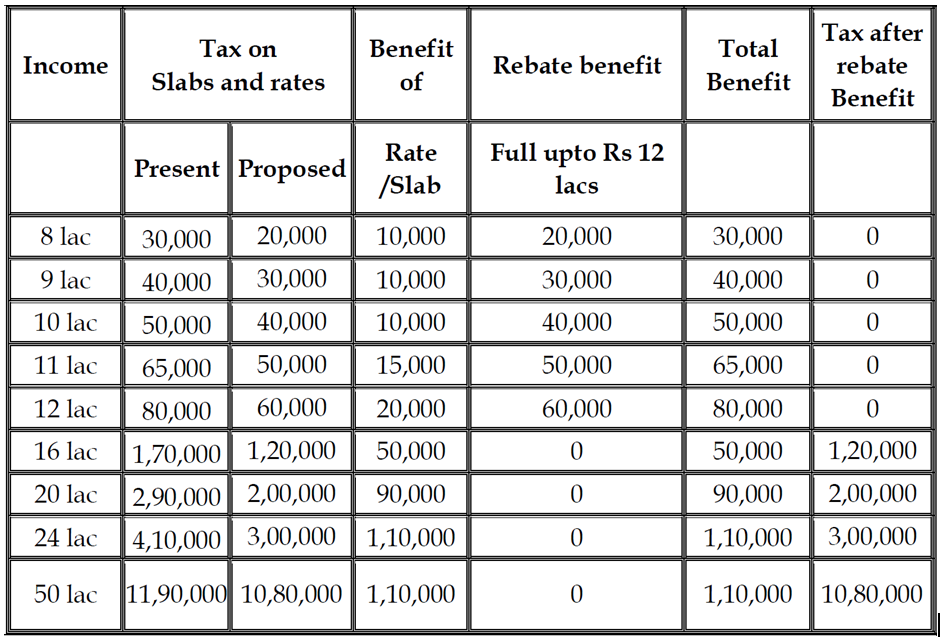

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

While underlining Taxation Reforms as one of key reforms to realize the vision of Viksit Bharat, Sitharaman stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation, she informed.

Quoting Verse 542 from The Thirukkural, the Finance Minister stated, “Just as living beings live expecting rains, Citizens live expecting good governance.”

Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Narendra Modi has taken steps to understand and address the needs voiced by our citizens, Sitharaman added.

More Stories

Paddy procurement accelerates, Token Tuhar Hath app simplifies procurement process

The procurement of paddy from farmers at the support price continues uninterrupted in all districts of Chhattisgarh.

Historic Implementation of Labour Reforms Under the Leadership of Prime Minister Narendra Modi: Chief Minister Sai

Chhattisgarh Chief Minister Vishnu Dev Sai today praised the leadership of Prime Minister Narendra Modi and Union Labour and Employment Minister Dr. Mansukh Mandaviya for the “historic” implementation of four labour codes in the country.

Digitization of over 6.5 million forms completed in the Special Intensive Revision (SIR) campaign

The Special Intensive Revision (SIR) of voter lists is underway in Chhattisgarh in full swing.

Chief Minister Sai presents Bastar Art statue of Birsa Munda to President Murmu

An inspiring and solemn moment was witnessed at a function held in Ambikapur on the occasion of Janjatiya Gaurav Diwas (Tribal Pride Day), when Chief Minister Vishnu Dev Sai presented a memento to President Droupadi Murmu, a statue of Dharti Aba Bhagwan Birsa Munda, created in Bastar Art.

Tribals getting new opportunities for education, livelihood, health and development: President Droupadi Murmu

President Droupadi Murmu today described the Central Government’s ‘Adi Karmayogi Abhiyan’, ‘Dharti Aba Janjati Gram Utkarsh Abhiyan’, and ‘Pradhan Mantri Janman Abhiyan’ as important steps for the upliftment of tribal society.

CM Sai, Union Minister Chouhan Release ChhattisKala Brand

With the aim of providing a single identity and a unified market platform for quality products, Chhattisgarh Chief Minister Vishnu Dev Sai and Union Agriculture and Rural Development Minister Shivraj Singh Chouhan today launched the much-awaited unified state brand, ChhattisKala, at the Dhamtari district headquarters.