New Delhi, February 01, 2025: There will be no income tax payable upto income of Rs 12 lakh under the new regime, presenting the Budget in Parliament today Union Minister for Finance and Corporate Affairs Nirmala Sitharaman said.

This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000, The Finance Minister said.

Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Presenting the Budget Sitharaman proposed an across-the-board change in tax slabs and rates to benefit all tax-payers.

Giving the good news to tax payers, the Finance Minister stated,

“There will be no income tax payable upto income of Rs. 12 lakh (that is average income of Rs.1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000.” Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Sitharaman said, “The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment”.

In the new tax regime, the Finance Minister proposed to revise tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 per cent |

| 8-12 lakh rupees | 10 per cent |

| 12-16 lakh rupees | 15 per cent |

| 16-20 lakh rupees | 20 per cent |

| 20- 24 lakh rupees | 25 per cent |

| Above 24 lakh rupees | 30 per cent |

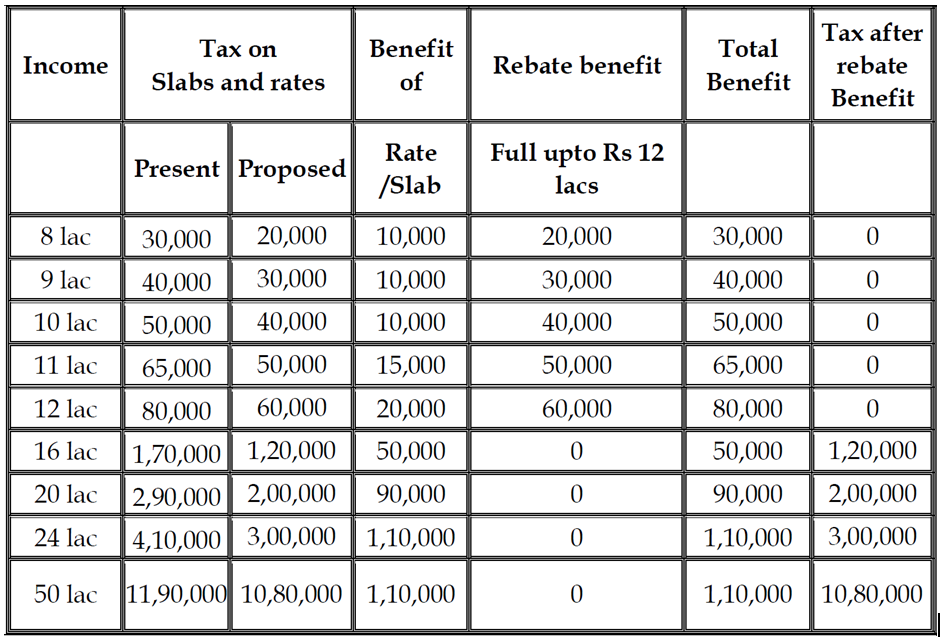

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

While underlining Taxation Reforms as one of key reforms to realize the vision of Viksit Bharat, Sitharaman stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation, she informed.

Quoting Verse 542 from The Thirukkural, the Finance Minister stated, “Just as living beings live expecting rains, Citizens live expecting good governance.”

Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Narendra Modi has taken steps to understand and address the needs voiced by our citizens, Sitharaman added.

More Stories

Record 149.25 lakh tons of paddy purchased in Chhattisgarh

In Chhattisgarh, a record 149.25 lakh tons of paddy has been purchased by the state government in this Kharif season under the minimum support price (MSP).

Chhattisgarh Governor Deka calls on Prime Minister Modi

Chhattisgarh Governor Ramen Deka today met Prime Minister Narendra Modi in New Delhi.

Modi congratulates Chandrika Tandon on winning Grammy award

Prime Minister Narendra Modi today congratulated musician Chandrika Tandon on winning Grammy award for the album Triveni.

33 councillors including the Chairperson of Nagar Panchayat Basna elected unopposed

Dr. Khushboo Abhishek Agarwal has been elected unopposed for the post of Chairperson from Nagar Panchayat Basna in Mahasamund district of Chhattisgarh.

Advanced Genome Centre at AIIMS Jammu

Gene therapy promises individualised management of disease for each patient, said Dr. Jitendra Singh, Union Minister of State for Science and Technology.

First time in 10 years no foreign interference: PM Modi

Prime Minister Narendra Modi said today for the first time in 10 years there has been no foreign interference ahead of the Parliament session.